For too many travel agencies, the volume of credit card transactions has surpassed current processing capacity especially if card reconciliation is a manual process. Although credit cards have revolutionized the speed and efficiency in which clients can pay, travel agency accounting teams struggling to manage the manual effort. Your company could face losing customers and investor confidence, as well as financial exposure due to misstatements.

These five steps will help you improve its credit card reconciliation process and ensure long-term sustainability.

Identify Root Cause

Identifying the root cause may be more difficult than implementing the solution. Travel agencies that struggle with credit card reconciliation may be experiencing issues in one or more areas. Examples of where the breakdown may be occurring:

-

Difficulty meeting deadlines during period end

-

Issues identifying the source of the credit card transaction

-

Problems with credit card processors

-

The trouble with large volumes of transactions that are being handled manually

-

Delays in remediating issues when they arise

Without proper knowledge of what exactly needs to be fixed and how much impact it is having on your company, there’s no feasible way to make progress towards improvement. Be sure there is an understanding of the challenges are before moving forward.

Be a Change Agent

Of course, there is nothing inherently wrong with travel agencies handling their reconciliation process manually. But at the end of the day, is it really the best way of doing it?

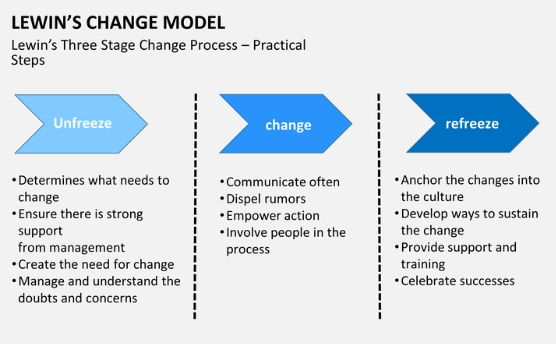

Improving outdated processes and adopting a culture of continuous process improvement will grow bottom-line profitability as employees are no longer burdened with manual intervention. Using change management techniques during this time will help with process and technology transitions. Lewin’s Change Model uses a simple methodology that can be easily shared and understood.

Trust the Team

Trust employees to handle any task presented to them. Though reliance on historical methods of managing problems is understandable, new opportunities for improvement and employee empowerment can come from adopting new methods. Overcoming traditional processes and Inertia is always a challenge for any business. By utilizing technology, businesses can see huge differences in their productivity and ability to service clients.

Build a plan that helps employees see the big picture by essentially explaining what’s really in it for them personally thus helping them readily adapt to change. In the end, employees begin noticing new issues and are motivated to solve them. The key is to trust the team to quickly pick up intuitive systems designed to solve the issues at hand.

Manage Standards Centrally

No matter what credit card reconciliation issues your company struggles with, the solution to the problem must have one characteristic: the ability to support standards centrally. Standardizing and centralizing your credit card reconciliation process ensures that bottlenecks and the risk of producing incorrect financial data within your workflow are removed. Ultimately, it guarantees that everyone is on the same page. Additionally, you are able to reduce your risk of misstatement across your credit card reconciliation process.

Evolve to Optimal Efficiency

Today, many companies handle their reconciliation process by manually combing through spreadsheet after spreadsheet. Despite how inefficient this process is, it’s an improvement over the pen and paper ledger books which were even more inefficient. The increase in credit card transactions has made the spreadsheet process obsolete and unmanageable. Just like companies once adopted current technology to improve upon their inefficient systems, travel agencies once again, need to consider automated credit card reconciliation software.